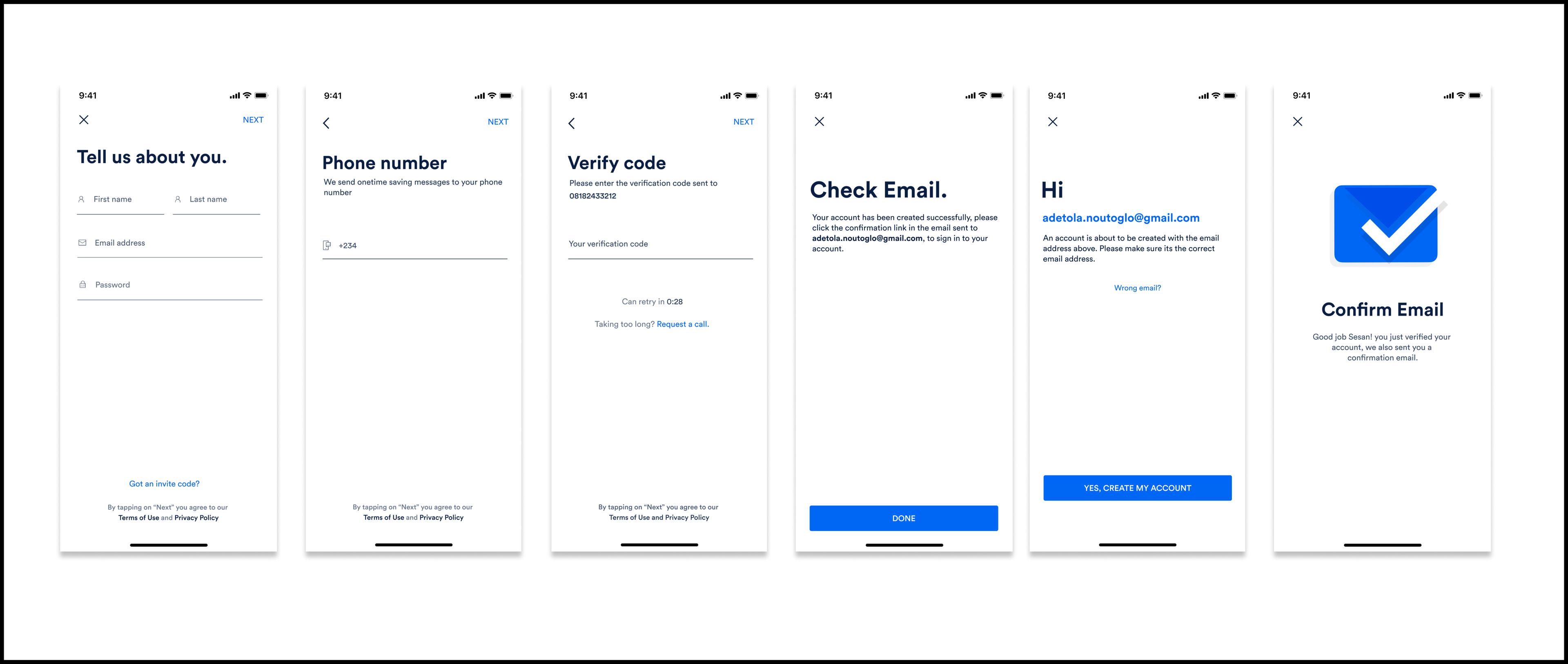

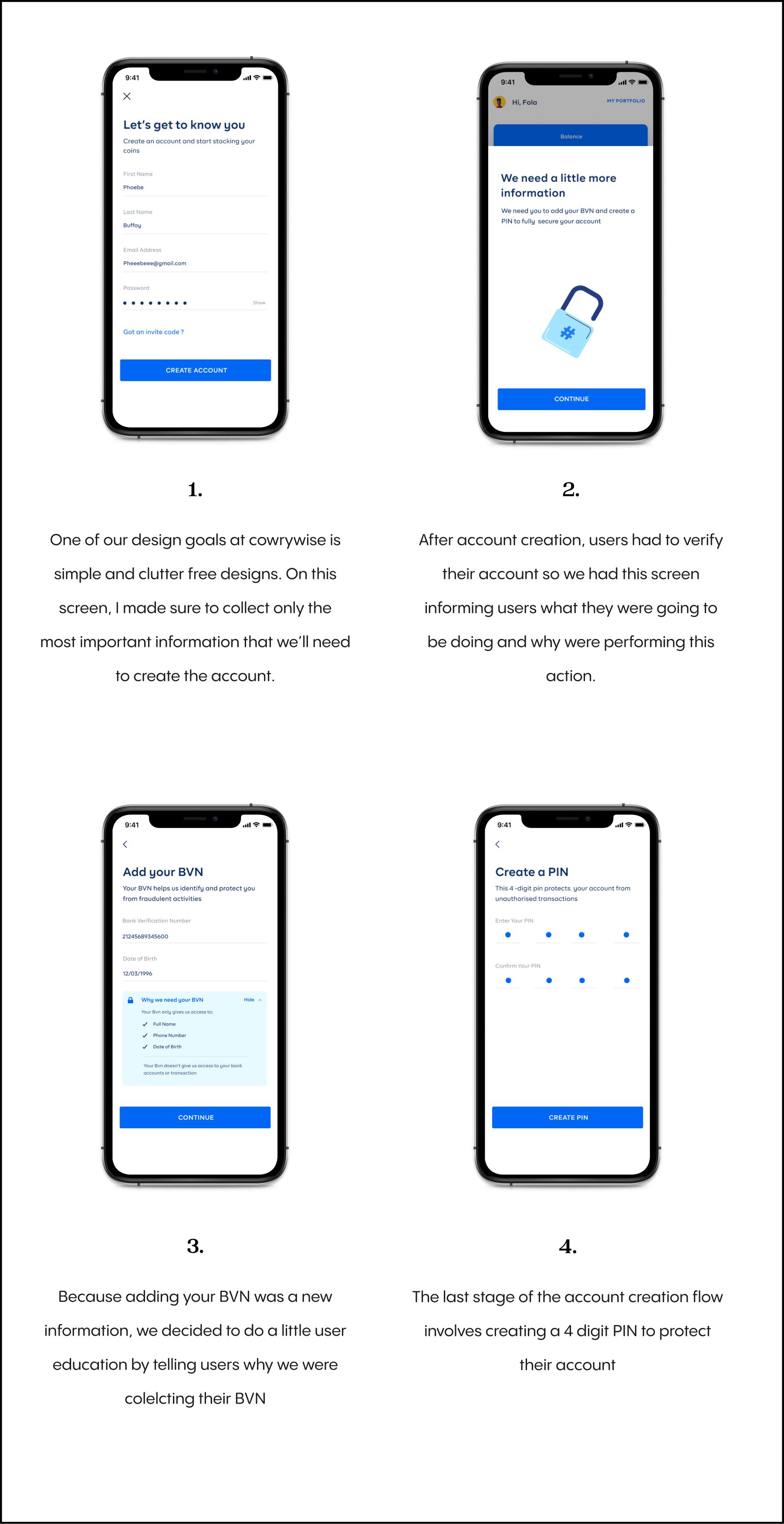

Redesigning the onboarding flow to reduce user drop-offs - Cowrywise

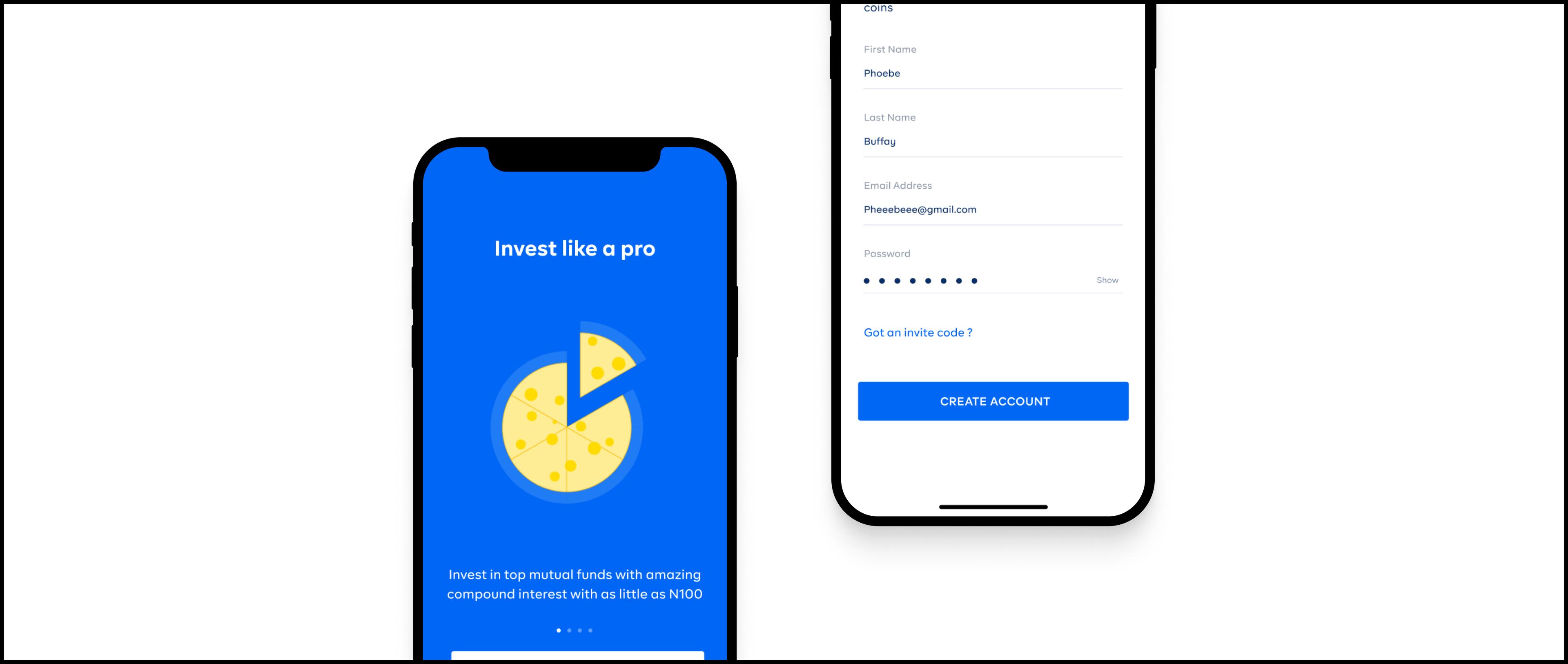

Cowrywise is a savings and investment product that helps Nigerians save and invest for their goals with as little as $1. Savings and investment plans created must be locked for a minimum of 3 months in order to gain interests and enable users build better savings habits.

Project Details

My Role

I owned the research and design process, end-to-end. I set up a research and testing plan, extracting insights from customer feedback , to designing, prototyping the entire flow and working with engineers.

Year

2019

Team

Myself, Mobile Engineers, Product Manager, Customer Success team.